Generating Mortality Rate Intensity for Life Insurance Applications through Novel Method of Successive Differencing Under the Parsimonious Generalised Makeham’s Framework

DOI:

https://doi.org/10.62050/ljsir2024.v2n2.338Keywords:

permissible interval, successive differencing, Generalised Makeham, curve of deathAbstract

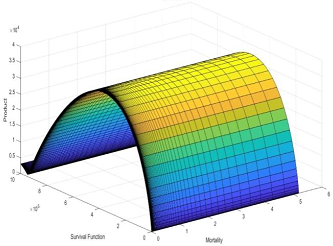

Developing and implementing age dependent mortality rates in functional forms have presented critical modelling problems for life insurance and annuity firms thereby creating serious research gaps. A recurring problem with the existing life tables is that their underlying generating functions are not capable of showing any evidence that mortality at 10 declines. This observed irregularity in the age pattern of mortality is the prime motivation in the search for analytical functions which fully capture the observed variations of mortality with age. To fill the gaps identified, the study aims to develop specific life table function under the Generalised Makeham’s framework. The objectives of this study are to (i) compute the mortality rate intensities (ii) compute the curve of deaths densities (iii) compute the probability of deaths and then compare the common domain of definition of these measures. From the method of successive differencing employed to model, the male ageing parameter value fall within the globally accepted interval for the. This method is superior to the method of maximum likelihood estimation which mostly violates the permissible interval of validity. Computational evidence from our analysis proves that under the Generalised Makeham’s law, the mortality rate intensity declines at .

Downloads

References

Carriere J.F. (1994). An investigation of Gompertz law of mortality. Actuarial Research Clearing House, 2, 161-177.

Debon, A., Montes, F., & Sala, R. (2005). A comparison of parametric models for mortality graduation. Application to mortality data for the Valencia Region (Spain). Sort, 29(2), 269-288.

Dickson, D.C., Hardy, M.R., & Waters H.R. (2013). Actuarial mathematics for life contingent risks. 2nd ed, Cambridge University Press.

Gauger, M. A., Lewis, J., Willder M., & Lewry, M. (2011). Actuarial Models: An Introductory Guide for Actuaries and other Business Professionals. 3rd ed. USA. BPP Professional Education Inc.

Gompertz B. (1825). On the nature of function expressive of the law of human mortality and the mode of determining the value of life contingencies. Philosophical Transactions of the Royal Society, 115, 513-585.

Hudec S. (2017). Modelling the force of mortality using local polynomial method in R. 20th International Scientific Conference AMSE Applications of Mathematics and Statistics in Economics. Szklarska Poreba, Poland. pp. 217-226.

Kara E.K. (2021). A study on modelling of lifetime with right-truncated composite lognormal Pareto distribution: Actuarial premium calculations. Gazi University Journal of Science, 34(1), 272-288. https://doi.org/10.35378/gujs.646899

Kiche, J., Aduda, J., Athiany, K.H.O., Apudo, B.O., & Wanjoya A. (2014). Comparison of survival models and estimation of their parameters with respect to mortality in a given population. Mathematical Theory and Modelling, 4(7), 164-177.

Makeham W.M. (1860). On the law of mortality and construction of annuity tables. Journal of the institute of Actuaries, 8, 301-310.

McCutcheon J.J. (1983). On estimating the force of mortality, Transaction of the Faculty of actuaries 38 (1983) 407-417.

Muzaki, T. R., Siswannah E. & Miasary S.D. (2020). Calculation of Tabaru funds using Makeham’s mortality law and Gompertz’s mortality law using the cost of insurance method. Journal of Natural Sciences and Mathematics Research, 6(1), 38-42.

Neil, A. (1979). Life contingencies. The Institute of Actuaries and Faculty of Actuaries, special edition.

Pavlov, V., & Mihova V. (2018). Application of Survival model in insurance. American Institute of Physics Conference Proceedings, 2025 (1), 1-12. https://doi.org/1063/1.5064883

Rabbi, A.M.F. (2013). Estimation of force of mortality from third degree polynomial of European Scientific Journal, 9(12), 233-240.

Siswono, G.O., Azmi, U., & Syaifudin W.H. (2021). Mortality projection on Indonesia’s abridged life table to determine the EPV of term annuity. Jurnal Varian, 4(2), 159-168. https://doi.org/10.30812/varian.v412.1094

Souza, F.C. (2019). Upper and lower bounds for annuities and life insurance from incomplete mortality data. Revista Contabilidade & Financas, 30(80). 282-291. https://doi.org/10.1590/1808 057x201807320

Putra, D. A., Fitriyati, N. & Mahmudi (2019). Fit of the 2011 Indonesian mortality table to Gompertz’s and Makeham’s Law of using maximum likelihood estimation. Indonesian J. of Pure and Applied Math., 1(2), 68-76. https://doi.org/10.15408/inprime.v1i2.13276

Downloads

Published

Issue

Section

License

Copyright (c) 2024 Lafia Journal of Scientific and Industrial Research

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.