LJUNG-BOX AUTOREGRESSIVE MODEL FOR THE RETURNS OF THREE NIGERIAN INSURANCE COMPANIES’ STOCKS

Mots-clés :

Insurance, Model, Price, Return, StockRésumé

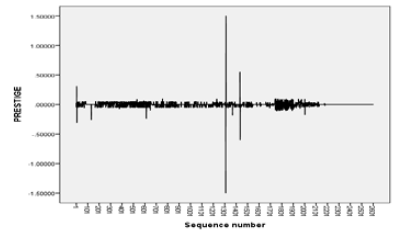

ANCHOR, MANSARD and STACO insurance companies’ return pattern in Nigeria were analyzed using the statistical package for social science (SPSS). The data for this study was got from the daily closing prices of the stocks of these companies between 2006 and 2018. The daily returns were computed and the analysis done using Time Series. Stationarity were detected when the plots of the return series were plotted. The Autocorrelation and Partial Autocorrelation plots were used to identify the models as well as the order of the

models for the three Insurance companies. The Autoregressive model of order two was fitted to the returns on ANCHOR and STACO stocks respectively. While MANSARD had Autoregressive model of order three fitted to it. The adequacy of the model was tested using Ljung-Box test by observing the residual plot. The results proved that the models suited the data.

##plugins.themes.default.displayStats.downloads##