MODELLING TIMES SERIES VOLATILITY: A CASE STUDY OF NIGERIA ECONOMIC VARIABLES

DOI:

https://doi.org/10.62050/fjst2025.v9n2.614Keywords:

Oil Price Volatility, Volatility Spillovers, DCC-MGARCH Model, Macroeconomic Stability, Resource-Dependent EconomiesAbstract

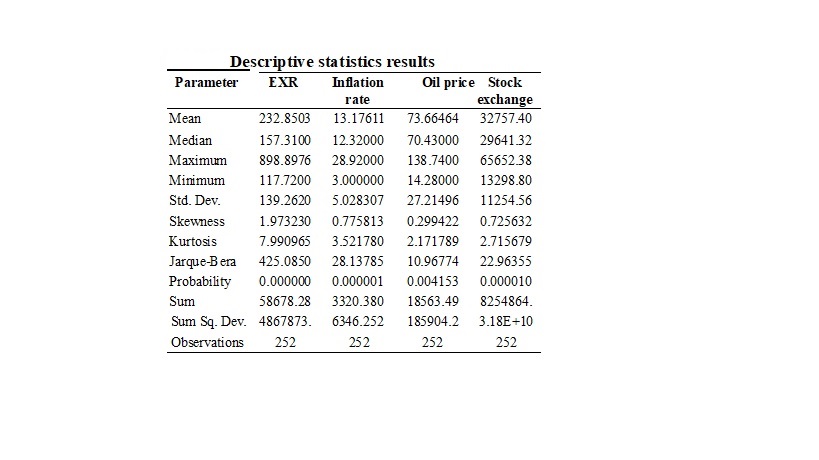

The profound vulnerability of the Nigerian economy to global oil price shocks necessitates a robust analysis of its macroeconomic volatility transmission mechanisms. This study employed the Dynamic Conditional Correlation Multivariate GARCH (DCC-MGARCH) model to investigate the interconnected volatility and time-varying spillovers among crude oil prices, exchange rates, inflation, and stock market performance using monthly data from January 2003 to December 2023. The results reveal significant volatility persistence and strong interdependencies among these variables, identifying oil price shocks and exchange rate fluctuations as primary drivers of volatility in inflation and stock returns. The analysis further uncovers distinct volatility regimes, including near-integrated GARCH processes for inflation and stock returns, and non-normal, fat-tailed distributions across all return series. While the model confirms high correlation persistence, it also exposes specification challenges, indicating that standard DCC frameworks may be inadequate for fully capturing the complex volatility dynamics inherent in Nigeria's oil-dependent economy. The study concludes that Nigeria remains acutely susceptible to oil-driven macroeconomic instability, underscoring the critical need for diversification policies and enhanced risk management strategies. These findings provide valuable insights for policymakers and investors while contributing to existing empirical literatures for analyzing multivariate financial-market interdependencies in resource-dependent emerging economies.

Downloads

References

Adekunle, W., & Aluko, O. A. (2020). Exchange rate volatility and inflation in Nigeria. African Journal of Economic and Management Studies, 11(2), 275–290. https://doi.org/10.1108/AJEMS-03-2019-0111

Adeoye, B. W., & Saibu, O. M. (2021). Oil price shocks and macroeconomic performance in Nigeria: A dynamic multivariate approach. Energy Economics, 93, 104985. https://doi.org/10.1016/j.eneco.2020.104985

Agyei, S. K., Adam, A. M., & Bossman, A. (2023). Dynamic connectedness between oil prices and African stock markets. International Review of Economics & Finance, 84, 1–18. https://doi.org/10.1016/j.iref.2022.11.015

Alao, R. O., & Alao, O. F. (2023). Volatility spillovers between oil prices and stock markets in Nigeria: A DCC-GARCH analysis. Journal of African Business, 24(1), 45–62. https://doi.org/10.1080/15228916.2022.2046231

Aloui, R., & Aïssa, M. S. B. (2021). Dynamic linkages between oil and stock markets in the Gulf. Energy Economics, 96, 105176. https://doi.org/10.1016/j.eneco.2021.105176

Apergis, N., & Miller, S. M. (2020). Do structural oil-market shocks affect stock prices? Energy Economics, 85, 104529. https://doi.org/10.1016/j.eneco.2019.104529

Bala, D. A., & Asemota, J. O. (2020). Oil price shocks, exchange rate, and inflation volatility in Nigeria: A GARCH-MIDAS approach. Resources Policy, 68, 101772. https://doi.org/10.1016/j.resourpol.2020.101772

Central Bank of Nigeria (CBN). (2023). Annual economic report. https://www.cbn.gov.ng

Dantani, A. A., Adenomon, M. O., Adehi, M. U., & Nweze, N. O. (2024). On the Comparison of VECH and BEKK in Modeling of Oil Prices, Stock Exchange, Exchange and Inflation Rates Volatility in Nigeria. Journal of the Royal Statistical Society Nigeria Group (JRSS-NIG Group) ISSN NUMBER: 1116-249X, 1(2), 90-109.

Dickey, D. A. & W. A. Fuller (1981). Likelihood ratio statistics for autoregressive time series with a unit root, Econometrica 49, 1057-1072.

Engle, R. F. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350. https://doi.org/10.1198/073500102288618487

Engle, R. F., Ledoit, O., & Wolf, M. (2011). Large dynamic covariance matrices. Journal of Business & Economic Statistics, 39(3), 1–14. https://doi.org/10.1080/07350015.2019.1617153

Iyke, B. N., & Ho, S. Y. (2021). Exchange rate volatility and inflation in Nigeria. Journal of Economic Studies, 48(5), 987–1002. https://doi.org/10.1108/JES-04-2020-0161

Kang, S. H., & Yoon, S. M. (2023). Dynamic spillovers between oil prices and exchange rates. Economic Modelling, 118, 106089. https://doi.org/10.1016/j.econmod.2022.106089

Orskaug, E. (2009). Multivariate DCC-GARCH model: With application to financial risk [Unpublished master's thesis]. Norwegian University of Science and Technology.

Osinubi, T. S., & Amaghionyeodiwe, L. A. (2022). Exchange rate volatility and stock market performance in Nigeria: A multivariate GARCH analysis. African Development Review, 34(2), 210-225. https://doi.org/10.1111/1467-8268.12645

Salisu, A. A., & Isah, K. O. (2023). Revisiting the oil price-stock market nexus. International Review of Financial Analysis, 85, 102456. https://doi.org/10.1016/j.irfa.2022.102456

Tule, M. K., Salisu, A. A., & Chiemeke, C. C. (2022). Oil price shocks and inflation in Nigeria. Energy Policy, 161, 112712. https://doi.org/10.1016/j.enpol.2021.112712

Zhang, D., & Ji, Q. (2021). Dynamic correlation between oil and stock markets. Energy Economics, 94, 105063. https://doi.org/10.1016/j.eneco.2021.105063